Note: This was a coursework project I did as part of a Digital Marketing course I was learning. The content in this document is observed and deduced from the information gathered through various sites (all the sites are listed at the bottom). If you find anything that doesn’t seem right, please understand that this analysis is not based on hard facts but only based on whatever I could gather. If there is something that you’d like to add to the content or correct a mistake, comment down below and I’ll take a look at it.

Brand Overview

The Man Company is a online first brand offering multi-category premium grooming products for men. The company was officially launched in 2015, went through 7 rounds of funding to raise $11 Million, and got acquired by Emami Group in June 2022. Emami Group valued the company at ₹400 Cr in 2024.

In 2012, the founders of the company realised that there was a gap in how self-care was portrayed to men as a matter of basic toiletries.

“Our men surely deserved much more than a bar of soap and family shampoo. They deserved to get their grooming needs discovered and met”, as mentioned in the company’s blog.

The Man Company was conceived and conceptualized in 2012-13. They wanted to offer premium grooming products that are free of harmful chemicals, infused with natural ingredients and premium essential oils. They also wanted to cover a range of categories from head to toe and deliver the products in a premium packaging.

The Man Comany was officially launched in 2015 as a company devoted to men’s grooming needs.

In 2018, the brand experienced a 300% growth complimented by 65% sales from direct channels and a direct access to 7 lakh customers.

In Sep 2019, Indian actor, Ayushmann Khurrana came onboard to become the brand ambassador. This helped significantly boost the brand popularity.

The company got acquired by the Emami Group in June 2022.

It was mentioned in a company blog that in 2023, the company had around 2 million happy customers.

Brand truth of The Man Company

Help men become a better version of themselves with all round grooming through premium grooming essentials and by providing knowledge about grooming.

Consumer truth of The Man Company

Quality grooming products, made with natural ingredients, grooming products for various needs – skin, hair, body, available at affordable prices and mainly – solve the problem (pain point) of the consumer.

Consumer & Brand truth analysis

The problem with grooming products is, they either come at a higher cost or the cheaper products tend to be ‘cheap’ and doesn’t solve the actual issue, like a fragrance that doesn’t last more than a few minutes.

The solution provided by The Man Company is that, they offer premium grooming products that solve the issue (pain point) in a wide range of categories.

The consumers need for quality grooming products at an affordable price is being met by TMC, and they are also offering a wide range of products in various categories that solve various paint points for the consumer.

I think this is the primary reason why people prefer The Man Company and their products. While affordability isn’t mentioned in the brand truth, the brand priced the products in an affordable range for the consumer.

The Man Company product offerings

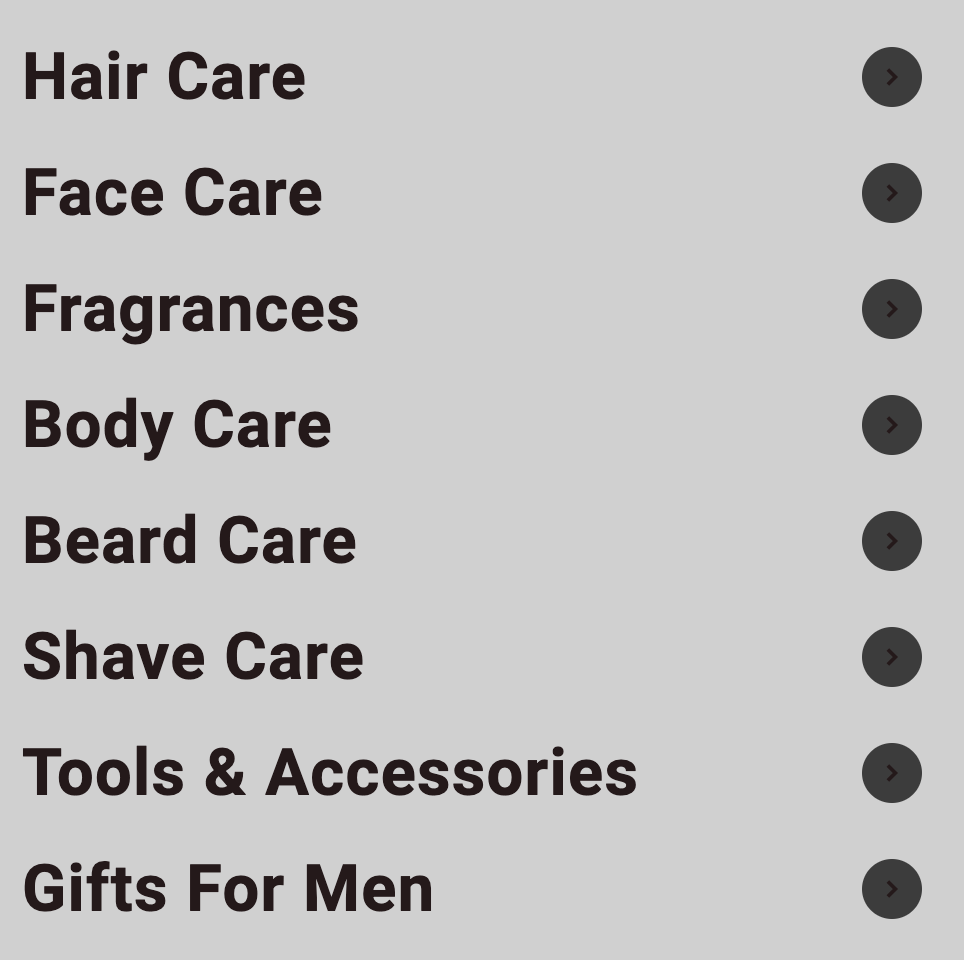

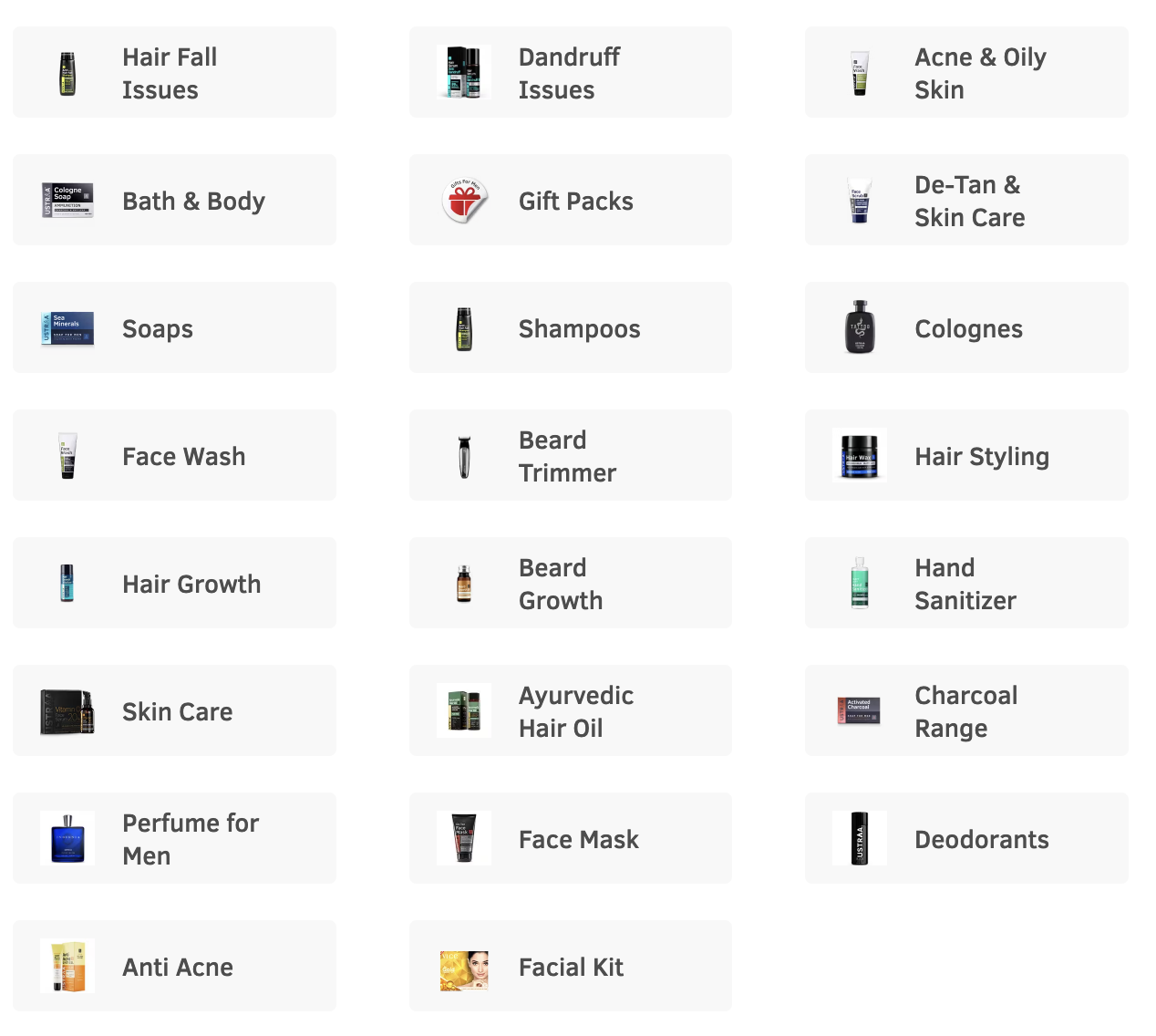

The Man Company sells products in all the categories mentioned in the image below.

These include things like beard oil, body spray, face cream, hair spray, beard shaper, face mask, etc.

The most popular products seem to be fragrance category products. These are sold in combo packs and also at different price points.

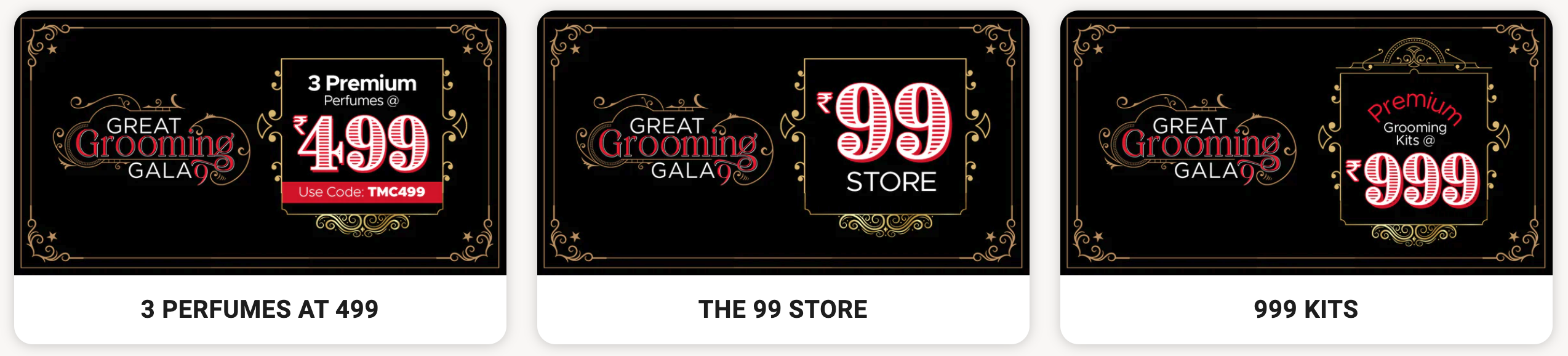

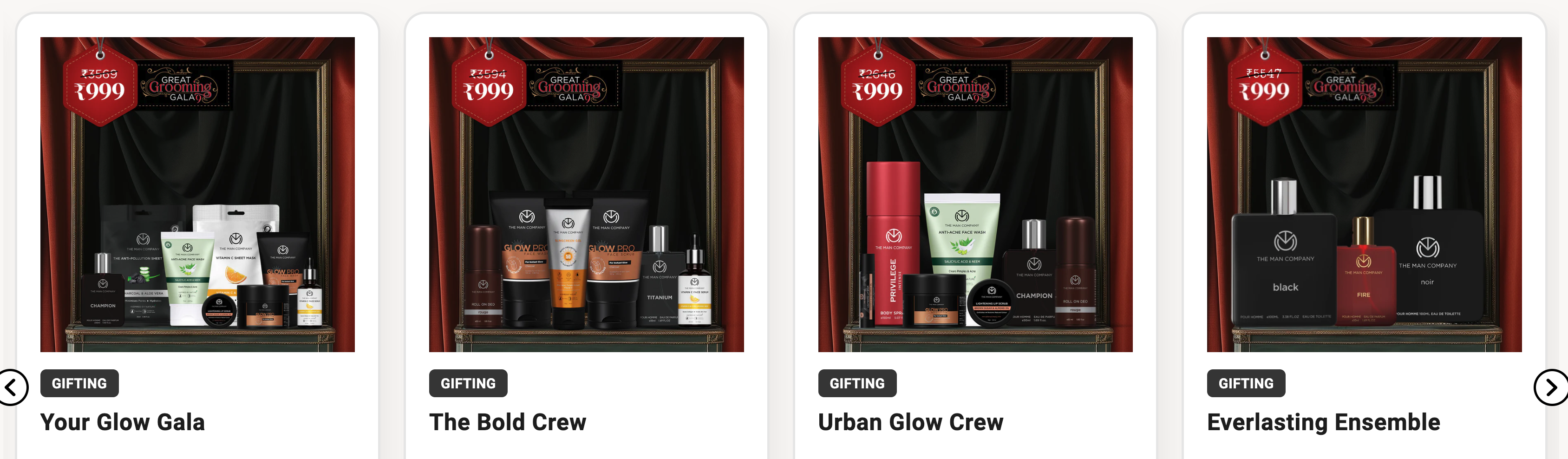

The products are marketed with aggressive pricing strategies (₹99, ₹499, ₹999) and they look premium and come in premium packaging.

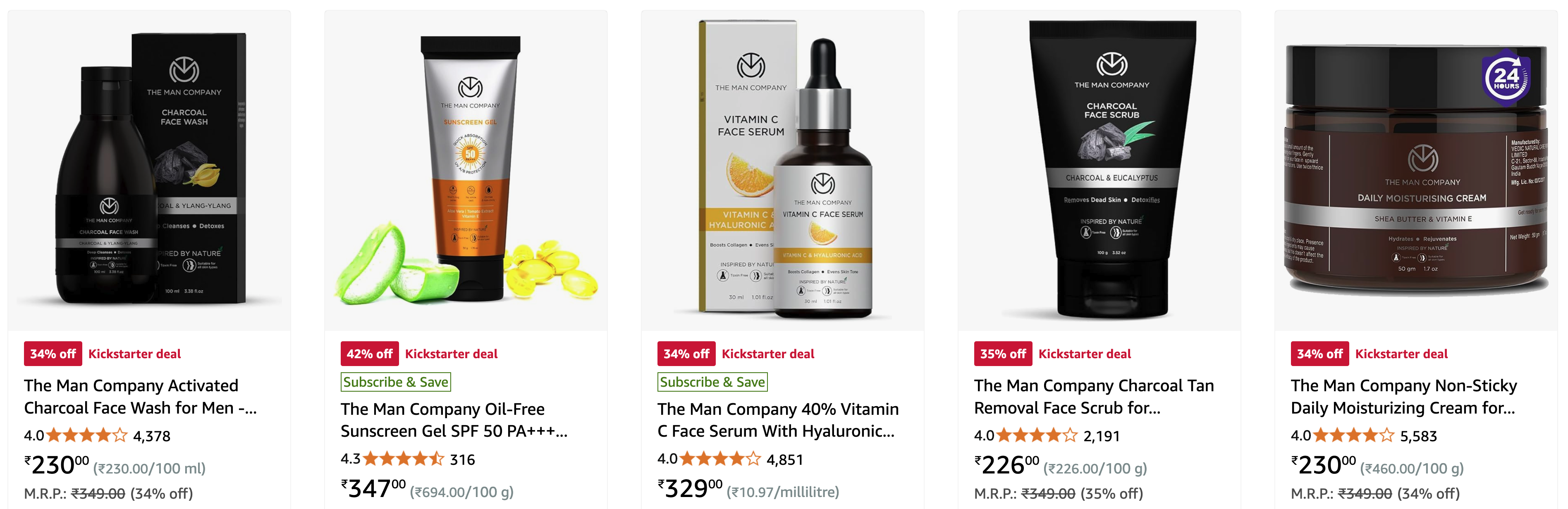

Regarding the actual products however, people seem to have mixed opinions.

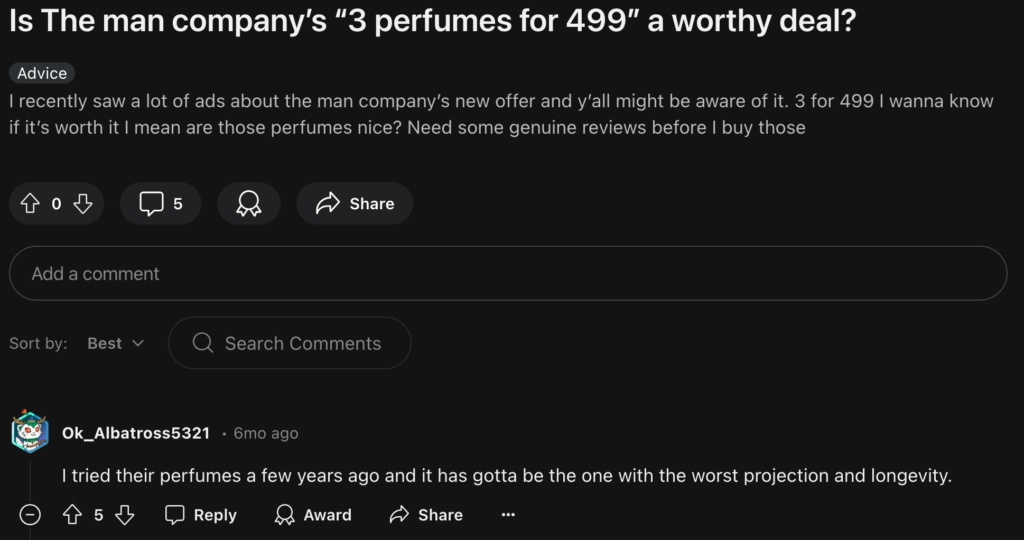

The rating and reviews for some products like fragrances on Amazon seem decent, but on reddit, people were discussing that the brand’s fragrance products are of low quality and doesn’t provide lasting impact.

People on reddit were saying to not fall for marketing hype and consider other brand fragrances instead.

Reddit discussion regarding TMC fragrances

For other products like facial scrubs, body wash, hair styling, etc. the average rating on Amazon seems to be around 4 out of 5, which is not bad considering the brand’s objective to position itself as a premium grooming product brand.

The Man Company website analysis

The design of the website could use some improvement. It doesn’t give off the premium vibes the brand associates itself with. Things like overemphasis on the price makes it look like a budget brand rather than a premium one. But whatever design exists seems to work for the brand, enough to generate revenue.

The ad messaging could be redone here (below screenshot) to emphasie the quality of the product and use price only as an action element.

Products are not clearly visible here (below screenshot). Using a transparent background could improve the aesthetics and make them feel premium.

The Man Company’s current market position

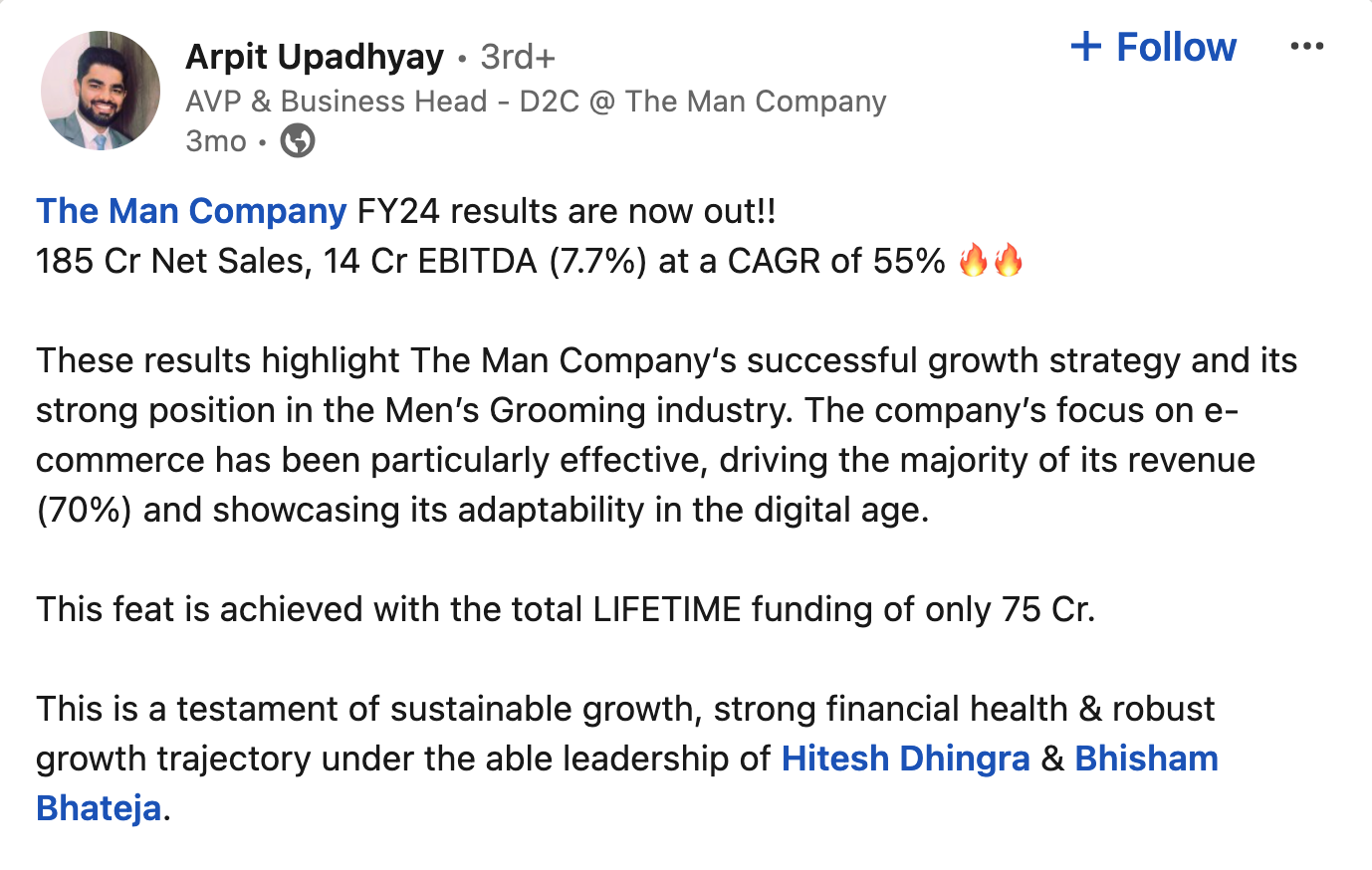

The company seems to be doing well financially. It posted a revenue of ₹185 Cr in March 2024. A significant portion of the revenue seems to be coming from e-commerce channels alone.

The brand’s website gets organic traffic around 450,000 users per month on average (checked through SemRush).

The brand seems to have a good reputation among entrepreneurs who are looking at the growth of the brand as an impressive achievement.

The brand experienced significant growth since its inception.

The success of the brand can be attributed to the marketing strategies used by the brand, celebrity endorsement, and the huge amounts of funding it was able to raise from the investors. Also to note the partner network it created with e-commerce brands, local salons and retail outlets.

The brand also established various channels to attract traffic like website, e-commerce and mobile app which all contributed to the brands success.

The Man Company’s recent marketing campaigns

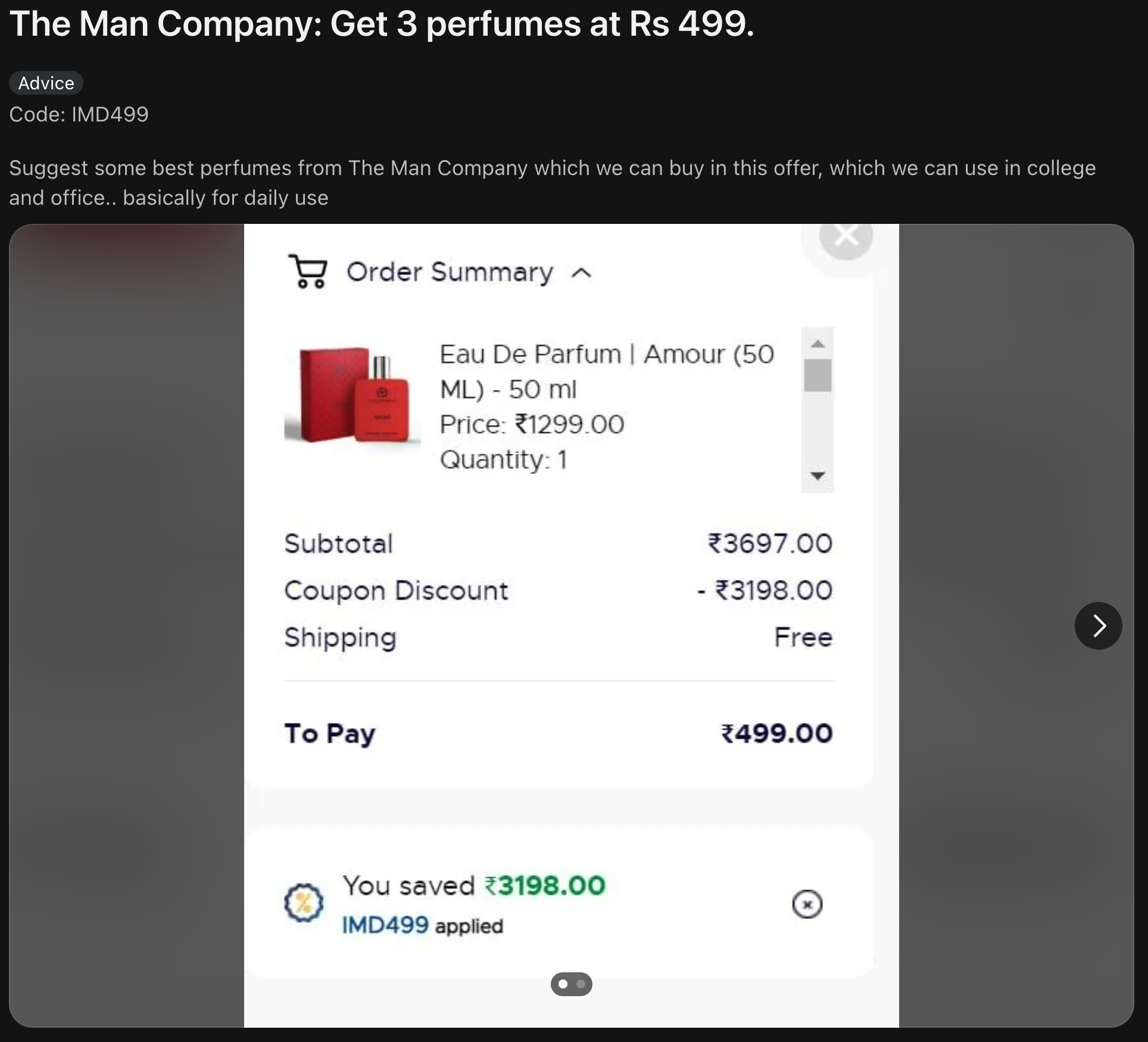

The brand is currently (as of writing this document) running a combo promotion on their website for perfumes. This seems to be a recurring promotion that the brand runs.

3 perfumes at ₹499. This seems to have garnered some attention.

A few individuals on reddit were discussing about this.

With the social media discussions about this (even though not entirely positive), I’d say this is something that worked well for the brand recently.

Competitor Research

These are some direct competitors I found for The Many Company

Major competitors offering products in all or most categories as offered by The Man Company. Only these brands will be analysed for competitive research.

These are some indirect competitors I found for The Man Company

These competitors operate in a different niche. Although they offer some similar products, the main objective of the brands is different.

Major competitors

USTRAA

- Sells products in all categories as sold by The Man Company

Some products may not be available in some categories like ‘grey hair’ products in ‘hair’ category. - Has a similar objective to TMC

- “USTRAA is a grooming brand for men who want to look their best. Our products are formulated in our in-house lab and are completely free of SLS, PARABENS & other harmful chemicals”

- Revenue as of March 2023 – ₹97 Cr

- Sells products online through website, mobile app and e-commerce channels all over India

- USTRAA can be considered a direct competitor with a healthy market share based on revenue, objective and type of products sold.

USTRAA SWOT analysis

Strengths

- More number of products listed on e-commerce channels compared to The Man Company

- Affiliate program with 17% commission

- Offers subscription plans for few grooming products

- Mobile app

- Unique expertise – Products are free of SLS, PARABENS

- Products formulated in in-house lab

Weaknesses

- Price of the products is slightly higher than TMC

- Almost 50% lower revenue per year compared to TMC

- Need some improvement in the way the product categories are presented

Opportunities

- Categorise products in a simpler way into main and sub-categories

- Could offer the missing products related to specific pain points that are offered by TMC and other competitors

- Expand market share by increasing brand promotions

- Collect email addresses of site visitors for email marketing

Threats

- Intense competition from TMC and other brands

- Aggressive pricing strategies followed by other brands

- Saturation of products due to similar ones being offered by other brands